Core Banking Transformation

Banks worldwide face an unprecedented set of challenges with increasing customer expectations, mounting pressures on cost, new regulatory & compliance requirements, unrelenting competition and a constantly evolving economic landscape. Moreover, non-traditional competition arising from the test-bed of emergent technologies like mobile, cloud, social and Big Data pose unique challenges to stay relevant and succeed.

Banks rely on Core Banking systems to innovate in the market-place as well as to standardize operations. However, legacy Core Banking platforms are inflexible and expensive to maintain, posing unique challenges in terms of scalability, security and regulatory compliance. The risk of ageing manpower with legacy knowhow is another significant risk to banks.

How Mexuz Helps?

Mexuz, with its comprehensive 'Change the Bank' and 'Run the Bank' services complemented with strong partnerships with industry leaders in Core Banking packages, is fully geared to be the trusted partner in your Core Banking Transformation journey. Our proposition is augmented by a comprehensive set of tools, methods, estimators and templates exclusive to the Core Banking System Transformation projects.

We have a robust framework, ready templates and strong thought leaders who work closely with the bank in building and executing the Core Banking Transformation strategy.

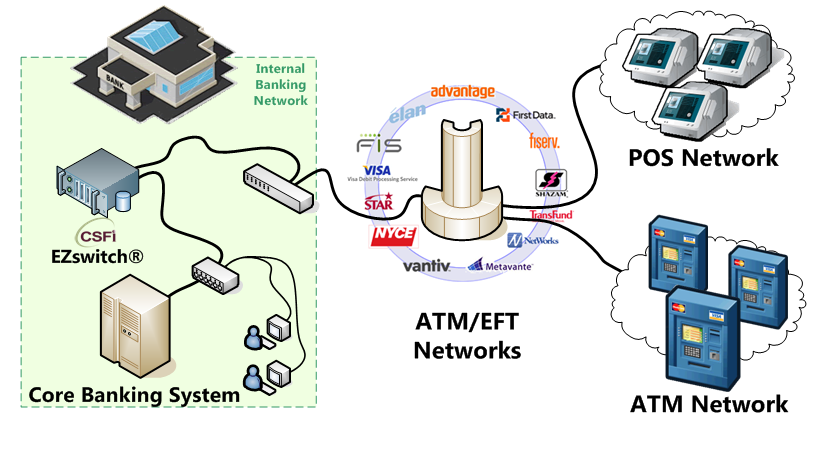

Core Banking System Integration Services

Mexuz offers comprehensive Change the Bank services for:

Best of breed COTS solutions like Oracle FLEXCUBE, Temenos T24, Finacle and Misys suite of products

Legacy and in-house customized Core Banking systems like Alnova and Hogan

We offer various Run the Bank services leading to effective Core Banking execution and roll-out. These services span operations, maintenance, implementation of updates and coordination with Independent Software Vendors (ISVs).